Virtual Aggregation at Its Finest

Monitor and Manage CSA Balances Across Brokers with Precision, Minus the Operational Complications of Custodial Aggregation

Why Castine Virtual? Because Broker Service Shouldn’t Come at the Cost of Confidentiality

No shared trade data, no visibility across brokers, just seamless CSA management that respects your relationships and protects your privacy.

Commission Management that respects your privacy

Castine Virtual safeguards your payment and trade data, ensuring brokers never see each other’s details. Your relationships stay intact, and your strategies stay protected.

CSA Management That Works for You and Your Brokers

Whether you run the CSA program yourself, rely on brokers, or prefer a smarter, more private approach, Castine Virtual makes it easy. No shared trade, payments or CSA commission balance data. Just clean, collaborative management that keeps your broker relationships strong.

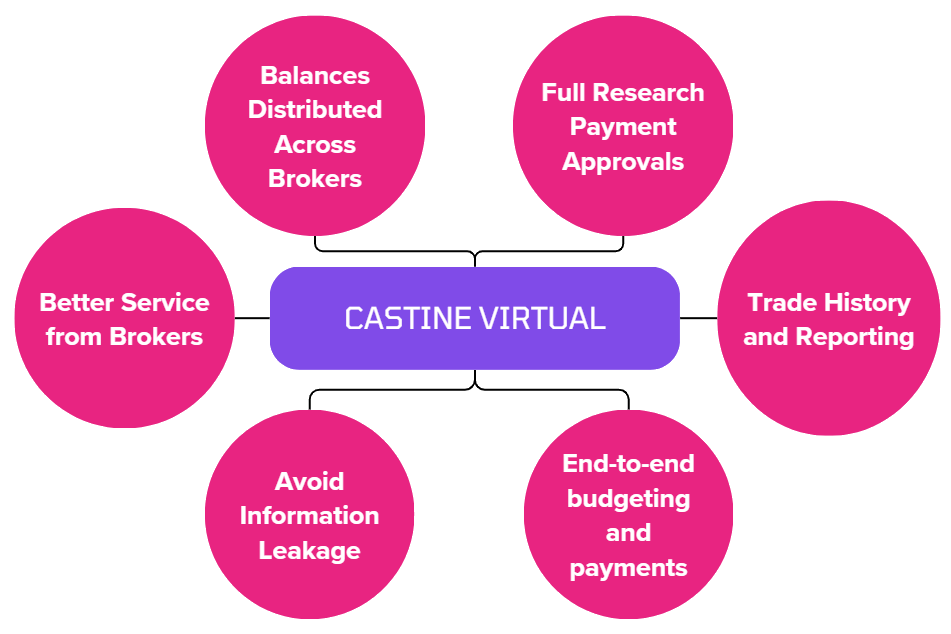

Benefits

Consolidated CSA Balance View Across All Broker Relationships

Castine Virtual gives you instant access to reconciled and unreconciled balances across all brokers. Payment requests are displayed alongside available funds, so you always have a complete, real-time view.

Integrated Research Evaluation and Payment Workflow

Castine Virtual streamlines the full lifecycle, from evaluating research providers and IRPs to setting budgets and executing payments. Its interactive review system connects directly to a robust approval workflow, enabling end-to-end oversight and control.

Flexible Approval Paths with Built-In Safeguards

From single-click confirmations to structured approval chains, Castine Virtual ensures every payment follows your rules. No transaction proceeds without full authorization.

Targeted Transparency, Not Full Exposure

Castine Virtual protects your payment data by keeping balances with individual brokers. Only the payments you initiate are visible, ensuring privacy without compromising efficiency.

End-to-End Trade Reporting Transparency

With Castine Virtual, you get complete reporting across all CSA trades and brokers. Reconciliation views ensure alignment between your records and your brokers’, giving you fast answers and full confidence.

Built for Today and Ready for Tomorrow

Castine Virtual starts with full CSA oversight in a single platform. As your needs evolve, the Asset Manager Toolkit expands your reach, enabling cross-asset reporting, budgeting, compliance, and contract management with precision and scale.

Features

Trade Reconciliation That Works Smarter, Not Harder

Castine Virtual streamlines reconciliation with intelligent mapping and adjustable tolerances. You get cleaner results, faster workflows, and fewer exceptions to chase.

Broker-Wide Commission Management with Trade-Level Precision

Castine Virtual offers customized CSA commission summaries across all brokers, with the ability to drill into trade-level data to handle one -off exceptions, eligibility rules, and principal trade nuances.

Seamless Connectivity

Castine Virtual connects with over 400 platforms, including OMS, accounting, and more. Trades are automatically loaded and unbundled per your rules, replacing manual steps with efficient automation that delivers with less effort and more clarity.

One Dashboard for Firm-Wide Analytics

No more juggling reports. Castine Virtual brings together your balances, payments, and CSA commission details in one easy-to-use dashboard, so you can see what matters and act fast.

Modular Architecture

Castine’s modular design lets you start with the tools you need, whether it’s invoicing, CSA management, or profitability reporting and expand seamlessly as your requirements grow. No rigid packages. Just adaptable, purpose-built components.

Future-Proof Your Technology Investment

Avoid the costly “rip and replace” cycle with modular architecture that adapts to regulatory changes and business evolution. Add capabilities as needed without disrupting existing workflows or losing historical data.