Trade Center

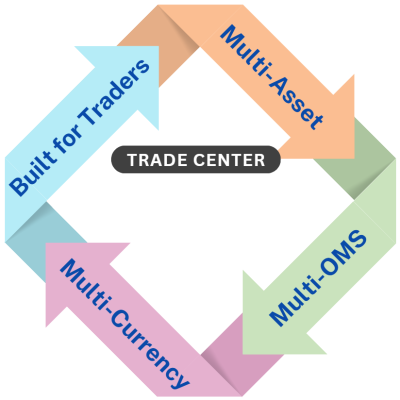

Castine’s Trade Center provides powerful trade reporting capabilities tailored to the complex needs of asset managers and hedge funds. With support for multiple asset classes, trading systems, and currencies, it gives traders, COOs, and CFOs a unified, high-visibility platform to manage activity, monitor balances, and drive informed decisions across the organization.

Trade Center is a powerful trade reporting system that manages both detailed and summary trade reporting across all asset classes, venues, trade types, currencies, brokers, and all Order Management Systems..

Bespoke trade reporting the team will greatly appreciate.

Offer your traders, COOs, and other stakeholders the tools they need to sift through trading activity and drill down into the details to answer their own questions, as well as those from clients, auditors, and regulators.

Order Management Integration

Trade Center is designed to integrate seamlessly with an unlimited number of sources, including OMS and clearing files, spreadsheets, and in-house systems. The system collects trade, commission, fee, and other data across equities, fixed income, contracts, currencies, derivatives, or any traded instrument. Trade Center allows for comprehensive summation across asset classes or focused reports for a single class. Additionally, TCA and other analytics may be added for side-by-side reporting.

Key Benefits

Trade Importing

Seamlessly ingest trades from any order management system (OMS), eliminating manual entry and reducing operational redundancy.

Report Distribution

Automate report scheduling and delivery to multiple stakeholders, ensuring timely, accurate insights without relying solely on broker-supplied commission data.

Customer Service Enablement

Empower client service teams with rapid search and reporting tools to respond quickly to client inquiries and provide detailed trade activity insights.

Internal Reporting Expansion

Track CSA balances and uncover trends across brokers, clients, and markets, enhancing oversight and informing strategic decisions.

Modular Integration

Trade Center is part of Castine’s Asset Manager Toolkit, which includes optional modules for commission unbundling, reconciliation, negotiated rate tracking, and more, offering a scalable foundation tailored to your operational needs.

Key Features

Custom Report Builder

Create tailored reports using flexible filters, by broker, client, market, CSA balance, trade type, or date range. Ideal for surfacing trends or anomalies.

Scheduled Distribution

Automate delivery to internal teams or external stakeholders. Reports can be sent daily, weekly, or monthly, ensuring consistent visibility without manual follow-up.

Multi-format Output

Export reports in various formats (e.g., Excel, PDF) to suit compliance, audit, or presentation needs.

Drill-down Capabilities

Click into summary data to reveal granular trade-level details, perfect for client service teams or internal audits.

Trend Analysis & Visualization

Generate charts and tables that highlight CSA usage patterns, broker performance, and client engagement over time.

Audit Trail & Versioning

Maintain historical versions of reports with timestamped changes, supporting transparency and regulatory readiness.

Role-based Access Control

Ensure the right people see the right data. Permissions can be customized by team, region, or function.